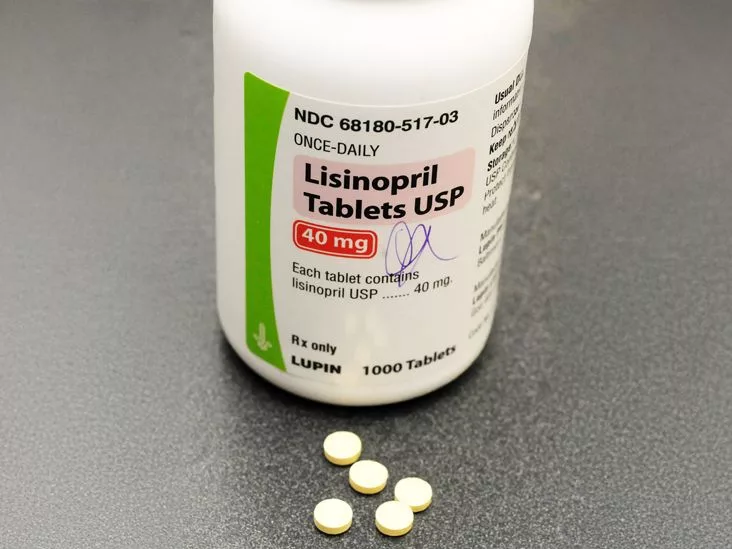

Hey there! If you’ve ever stared at a prescription bottle and wondered, “Will Medicare actually foot the bill for my blood pressure meds?” – you’re not alone. The short answer is yes, Medicare can cover lisinopril, but there are a few moving parts you’ll want to understand. Let’s break it down together, step by step, so you can feel confident about your coverage and keep that heart‑healthy pressure in check.

Quick Answer

Does Medicare cover lisinopril?

Yes. Medicare Part D and most Medicare Advantage (Part C) plans list lisinopril on their formularies, usually in the low‑cost Tier 1. Whether you’re on Original Medicare + Part D or a Medicare Advantage plan with prescription coverage, you’ll likely see a small copay after you meet your deductible.

Why should you care?

Understanding the details can save you from surprise bills, help you choose the right plan during Open Enrollment, and let you plan ahead for any out‑of‑pocket costs. After all, managing high blood pressure is a marathon, not a sprint – you need a reliable safety net.

Medicare Basics

What is Medicare Part D?

Part D is the prescription‑drug add‑on to Original Medicare (Parts A & B). It works a bit like a subscription service for meds. You pick a plan, pay a monthly premium, and then you’re covered for the drugs on that plan’s formulary.

Typical Part D benefit phases

| Phase | Description | Typical Cost to You |

|---|---|---|

| Deductible | You pay 100 % of drug costs until the deductible is met. | Varies, often $0‑$550 (2025 limit $590) |

| Initial Coverage | Plan pays a share; you pay a copay or coinsurance (often $0‑$10 for Tier 1). | Low copay |

| Coverage Gap (“Donut Hole”) | Higher share of cost; you may pay more per prescription. | Typically 25‑33 % of price |

| Catastrophic Coverage | After out‑of‑pocket threshold (≈ $2,000 in 2025), you pay a nominal amount. | ≈ $0‑$5 |

What’s Medicare Advantage (Part C)?

These are private‑insurance plans that bundle Medicare Part A, Part B, and usually Part D into one monthly premium. Many seniors love the simplicity, but remember to check the plan’s network and formulary before you sign up.

Formulary & Tier Basics

A formulary is simply the list of drugs a plan agrees to cover. Tier 1 typically means the cheapest out‑of‑pocket cost, Tier 2 a bit higher, and so on. Lisinopril almost always lands on Tier 1 – a fact supported by GoodRx data that shows 100 % of Medicare prescription‑drug plans list it there.

How Lisinopril Is Covered

Is lisinopril usually covered?

According to Medicare.org, “100 % of Medicare prescription‑drug plans cover lisinopril.” That means regardless of the plan you pick, you should see it on the formulary – unless you’re on a very niche plan with a restricted list.

Cost scenarios you might see

Let’s walk through a typical year for someone on a standard Part D plan:

- Before deductible: You pay the full price (sometimes $30‑$50 for a 30‑day supply of generic lisinopril).

- After deductible – Initial Coverage: Your copay drops to $0‑$10 because lisinopril is Tier 1.

- In the “donut hole”: Costs creep up; you might pay $15‑$20 per fill.

- Catastrophic phase: Costs shrink again to almost nothing.

Generic vs. brand‑name pricing

The generic (lisinopril) is cheap – often under $10 for a month’s supply. Brand names like Prinivil or Zestril can be $30‑$50, but most plans push you toward the generic. If you ever get a brand‑name prescription, ask your pharmacist whether a generic swap is possible; it usually saves you money.

State‑specific variations & Low‑Income Subsidy (LIS)

If you qualify for extra help (the Low‑Income Subsidy), your premiums, deductibles, and copays can be dramatically reduced. Check your eligibility on the Medicare website or call your State Health Insurance Assistance Program (SHIP). It’s a free resource that can make a big difference.

Verify Your Coverage

Check the formulary online

Log into Medicare.gov’s Plan Finder, type “lisinopril” into the search box, and you’ll see which tier it lands on for each plan. You can download the PDF of the formulary for a deeper dive.

Ask your pharmacy or doctor

When you pick up your prescription, ask the pharmacist: “Is lisinopril on my plan’s formulary? What tier is it?” Your doctor can also call the plan’s “prescriber hotline” to confirm coverage before they write the script.

Talk to a Medicare counselor

Every state has a SHIP, a free, unbiased counseling service. They can walk you through plan comparisons, help you understand costs, and even assist with enrollment if you’re overwhelmed.

If lisinopril isn’t covered—what next?

First, request a prior‑authorization. Your doctor can justify why lisinopril is medically necessary. If the plan still says no, consider therapeutic alternatives such as losartan or enalapril – many are also low‑cost and covered. And remember, you can always switch plans during the Annual Election Period (October 15 – December 7) if a better option shows up.

Benefits vs. Risks of Lisinopril

Why doctors love lisinopril

Lisinopril is an ACE inhibitor that relaxes blood vessels, lowers blood pressure, and reduces the workload on the heart. It’s proven to cut the risk of strokes, heart attacks, and heart‑failure hospitalizations. Medicare.org notes it’s also used after a heart attack to improve survival.

Common side effects you should know

- Dry cough – a classic ACE‑inhibitor trick.

- Dizziness or light‑headedness, especially when you first start.

- Elevated potassium or kidney‑function changes – your doctor will order labs periodically.

- Fetal toxicity – never take during pregnancy.

If any of these become bothersome, call your prescriber right away. Adjusting the dose or switching to another class is often straightforward.

Monitoring while on Medicare

Lab work for kidney function and electrolytes is generally covered under Part B when ordered by your doctor, so you won’t have extra drug‑coverage costs for the tests. Keep those appointments – they’re part of the safety net that keeps lisinopril working for you.

Real‑World Example

Maria’s story: saving $15 a month

Maria, 68, lives in Ohio and was diagnosed with hypertension three years ago. She originally had Original Medicare + a standalone Part D plan that charged $12 per month for lisinopril. After a conversation with her local SHIP counselor, she switched to a Medicare Advantage plan that bundled prescription coverage and listed lisinopril on Tier 1 with a $0 copay. The move shaved $15 off her monthly medication budget and gave her one fewer bill to track.

What helped Maria? She:

- Checked her current plan’s formulary (it listed lisinopril, but at a higher tier).

- Compared at least three alternative plans using the Medicare Plan Finder.

- Asked her pharmacist to confirm the tier placement before the switch.

- Enrolled during the Open Enrollment window.

Now she feels more in control of her health and her wallet.

Takeaway

Understanding how Medicare covers lisinopril isn’t just about numbers – it’s about peace of mind. Yes, most plans will cover the medication, but the exact cost depends on your plan’s deductible, the benefit phase you’re in, and whether you qualify for extra help. By checking your formulary, speaking with your pharmacist, and using free counseling resources, you can make sure you’re getting the best possible deal.

So, what’s your next step? Grab a coffee, pull up the Medicare Plan Finder, and see where lisinopril sits on your plan’s list. If you have questions, drop a comment below or give your local SHIP a call. You deserve a clear, affordable path to keeping that blood pressure in the healthy zone.

Leave a Reply

You must be logged in to post a comment.