Quick answer: Most Medicare Part D and Medicare Advantage drug plans do cover Rinvoq, but the amount you actually pay can swing wildly depending on your plan’s formulary tier, prior‑authorization rules, and the 2025 $2,000 annual out‑of‑pocket (OOP) cap.

Why it matters: Knowing exactly how your specific Medicare drug plan handles this JAK inhibitor helps you dodge surprise bills, tap into extra‑help programs, and decide whether a different plan or a savings card could bring your cost down to $0.

Medicare Basics

First things first—what does Medicare even cover when it comes to prescription drugs? In a nutshell, Part D is the stand‑alone prescription‑drug benefit you can add to Original Medicare (Parts A & B). Medicare Advantage (Part C) plans often bundle medical and drug coverage together, and they can be just as generous as stand‑alone Part D plans, sometimes even more so.

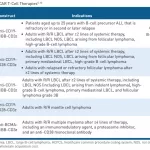

Rinvoq (upadacitinib) is typically placed on formularies as a Tier 5 brand drug. That means you’ll usually face a coinsurance of around 25 % of the drug’s price, but you won’t see a flat copay like you might with a generic. The good news? Most Part D plans list Rinvoq outright, so you won’t have to hunt for an “off‑formulary” exception in most states.

According to Medicare‑Help’s 2023 drug‑price data, roughly 20 Part D plans in New Jersey cover Rinvoq, and the drug sits on Tier 5 without requiring prior authorization. Your own state may look a little different, so always double‑check the formulary for your specific plan.

Rinvoq Cost

The sticker price of Rinvoq is eye‑popping: $6,752.77 for a 30‑day supply in 2025. But you probably won’t pay anywhere near that amount if you have Medicare. The new 2025 legislation caps total prescription spending at $2,000 per year for every beneficiary, automatically applying to anyone enrolled in a Part D plan. Once you hit that ceiling, your plan foots the bill for the rest of the year.

Other cost‑driving factors include:

- Deductible: Up to $590 in 2025 before your plan starts paying.

- Formulary tier: Most plans put Rinvoq at Tier 5, meaning you’ll pay roughly 25 % of the drug’s negotiated price.

- State‑specific pricing: In New Jersey, the average retail price per pill was $201.87 in 2023, translating to about $6,056 per 30‑day supply.

If you’re looking to shrink that bill, you have a few options. The federal “Extra Help” program (sometimes called Low‑Income Subsidy) can dramatically lower your deductible, coinsurance, and OOP maximum if you meet income and resource limits. AbbVie also runs a Rinvoq Complete Savings Card that can reduce your cost to $0 per prescription—but it’s only usable for commercially insured patients, not with Medicare (see the disclaimer on the card’s website).

Here’s a quick snapshot of the numbers you might see:

| Cost Component | Typical Medicare Scenario | Possible Lowest Cost (with Extra Help) |

|---|---|---|

| List price (30‑day) | $6,752.77 | $6,752.77 |

| Coinsurance (25 % of negotiated price) | ~$1,700 | ~$250 |

| Annual OOP cap | $2,000 (2025) | $2,000 (2025) |

| Deductible | $590 max | $0 (Extra Help) |

Remember, these are ballpark figures. Your exact cost will depend on your plan’s negotiated price, your deductible status, and whether you qualify for any extra‑help programs.

Plan Selection Guide

Wondering how to verify whether your current Medicare drug plan covers Rinvoq? The process is easier than you might think:

- Log into Medicare.gov’s Plan Compare tool and select “View/Compare Drug Formularies.”

- Enter “Rinvoq” (or its generic name “upadacitinib”) in the search bar.

- Check the tier placement, any prior‑authorization or step‑therapy requirements, and whether a specialty pharmacy is required.

When you call your plan’s pharmacy‑benefits hotline, ask these three golden questions:

- “Is Rinvoq listed as Tier 5 or a higher tier on my formulary?”

- “Do I need prior authorization or step therapy before the drug will be covered?”

- “Will I have to pick it up at a specialty pharmacy, or can I use any retail pharmacy?”

If the answers reveal high out‑of‑pocket costs, consider switching plans during the annual Open Enrollment window (Oct 15–Dec 7). Use the same Medicare Plan Finder tool to run side‑by‑side cost comparisons. A quick case study can illustrate why this matters:

Case Study: Maria, 68, has rheumatoid arthritis and was on a Part D plan that listed Rinvoq as Tier 5 with a 25 % coinsurance—her monthly bill was about $300. By reviewing the formulary during Open Enrollment, she discovered another plan that placed Rinvoq on Tier 4 with a 15 % coinsurance and a $150 monthly cost. After switching, she saved roughly $1,800 in the first year and stayed comfortably under the $2,000 OOP cap.

Extra Help

If your income is below $20,000 (or you receive SSI), you probably qualify for Medicare’s “Extra Help” subsidy. This program can wipe out your deductible, lower your coinsurance to as little as $2 per prescription, and eliminate the annual OOP cap entirely for eligible beneficiaries.

To see if you qualify, use the Medicare Extra Help eligibility calculator. If you do, the application is simple—fill out a short form online or call the Medicare hotline.

Beyond federal assistance, AbbVie offers a suite of patient‑support resources. The “Rinvoq Complete” program provides a dedicated nurse ambassador, a 1‑to‑1 savings specialist, and an easy‑to‑use mobile app for medication reminders. While the free Savings Card can’t be combined with Medicare, the program’s insurance specialists can guide you through filing for Extra Help, locating a specialty pharmacy, and understanding your plan’s formulary.

Other community resources, such as NeedyMeds and the Medicine Assistance Tool, list pharmaceutical assistance programs that may further reduce or eliminate your cost if you meet their eligibility criteria.

Risk & Benefit

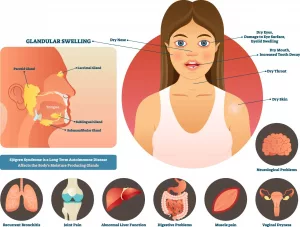

Rinvoq’s clinical benefits are impressive. In more than 100,000 patients since its 2019 launch, the drug has shown rapid symptom relief for rheumatoid arthritis, psoriatic arthritis, ulcerative colitis, and several other inflammatory conditions. The JAK‑inhibitor class works by interrupting the signaling pathways that drive inflammation, offering an oral alternative to injectable biologics.

But every medication carries risks. The FDA’s boxed warning highlights serious infections (including tuberculosis), cardiovascular events (especially in patients over 50 with heart‑ disease risk factors), malignancies, and blood clots. If you have a history of serious infection, smoking, or a heart condition, be sure to discuss these concerns with your rheumatologist before committing to long‑term therapy.

Balancing cost with safety is a personal decision. A cheaper plan that forces you into step therapy might delay getting the drug that works best for you, while a more expensive tier could give you immediate, full‑dose access. Talk to your doctor about the risk‑benefit profile, and ask them to document any contraindications in your medical record—this can be crucial if your insurer requests prior authorization.

Take Action

Ready to take the next step? Here’s a simple checklist you can download (or copy into a notes app) to keep you on track:

- Log into Medicare.gov and view your plan’s formulary for Rinvoq.

- Call the pharmacy benefits hotline and confirm tier, prior‑auth, and specialty‑pharmacy requirements.

- Run a cost comparison using the Medicare Plan Finder before Open Enrollment ends.

- Check eligibility for Extra Help and apply if you qualify.

- Contact AbbVie’s Rinvoq Complete nurse ambassador at 1‑800‑2RINVOQ for personalized assistance.

- Schedule a conversation with your rheumatologist to discuss any safety concerns.

Each of these actions brings you one step closer to a clear picture of what you’ll actually pay and how you can keep your treatment affordable. Remember, you don’t have to navigate this alone—resources are just a phone call or click away.

If you’ve gone through this process before, share your experience in the comments. What tricks helped you save money? If you’re just starting out and feel overwhelmed, feel free to ask a question; we’re all in this together.

Understanding Rinvoq Medicare coverage can feel like decoding a complex puzzle, but with the right tools and a bit of patience, you’ll be able to piece together a plan that protects both your health and your wallet. Stay informed, stay proactive, and most importantly, stay hopeful—you deserve a treatment plan that works for you, both medically and financially.

Leave a Reply

You must be logged in to post a comment.