Hey there! If you’ve ever felt a little lost trying to figure out how to keep your prescriptions rolling while you sort out your Medicare plan, you’re not alone. Let’s cut through the jargon together and get straight to the good stuff: what temporary Medicare drug coverage is, who can use it, how to activate it, and why it might be just the safety net you need. Grab a coffee, get comfy, and let’s chat.

Why Temporary Matters

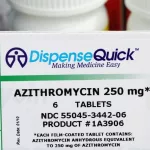

Picture this: you’ve just discovered a new medication that keeps your blood pressure steady, but the paperwork for a permanent Part D plan is still in the mail. In the meantime, you’re staring at an empty pill bottle. That’s where temporary coverage swoops in like a friendly neighbor, handing you a 30‑day supply so you don’t miss a beat.

Real‑world pain of waiting for Part D

Take Maria, a 68‑year‑old living on a fixed income. She switched her Medicare Advantage plan in early January, only to learn her heart medication wasn’t on the new formulary. Without a bridge, she’d have faced a dangerous gap. Thanks to a temporary drug plan, she got a one‑month supply while her doctor and the plan sorted a formulary exception. Stories like Maria’s are all too common, and they highlight why a “bridge” isn’t just nice to have—it’s essential.

Temporary vs. transition fills

There’s a subtle, but important, difference between the LI NET program (the “temporary coverage” we’re focusing on) and the standard Medicare “transition fill.” Both aim to prevent gaps, but they’re triggered by different circumstances.

| Feature | LI NET (Temporary Coverage) | Standard Transition Fill |

|---|---|---|

| Who qualifies | Low‑income beneficiaries not yet in a Part D plan | Anyone switching plans or hitting a formulary change |

| Supply length | 30 days (up to 90 days retroactive for dual‑eligible) | One‑time 30‑day supply, 90‑day eligibility window |

| Cost to beneficiary | $0 for LIS/Extra Help; minimal copay otherwise | Same as plan’s usual cost‑share |

| Pharmacy use | Any network pharmacy | Any network pharmacy |

Who Is Eligible

Low‑income Medicare (LI NET) participants

The LI NET program—standing for Limited Income Newly Eligible Transition—was created to help folks who don’t have prescription coverage yet but qualify for low‑income assistance. According to the CMS LI NET fact sheet (2025), eligibility falls into two buckets:

- Full‑benefit Dual‑Eligible and SSI‑Only beneficiaries: They can receive retroactive coverage for up to 36 months.

- Low‑Income Subsidy (LIS) or “Extra Help” recipients: They get a 30‑day supply at the pharmacy counter, with no premium.

In plain English, if you’re on Medicaid, receiving Supplemental Security Income, or already have a Medicare Savings Program (QMB, SLMB, QI), you’re probably in the first bucket. If you’ve gotten a “notice of award” for Extra Help, you’re in the second.

Non‑LI NET temporary options – the transition fill rule

Even if you don’t qualify for low‑income assistance, you might still qualify for a transition fill. The rule applies when you:

- Switch a Part D plan during the Open Enrollment Period (Oct 15–Dec 7) and discover a drug you already take isn’t covered.

- Experience a formulary change within the first 90 days of a new plan.

- Run into utilization‑management hurdles (prior authorization, step therapy, quantity limits) for a drug you’re already on.

This information comes straight from Medicare Interactive’s transition refill guide (2025).

Special cases: long‑term care and emergency fills

If you reside in a long‑term care (LTC) facility, the rules get a little friendlier. UnitedHealthcare notes that after the standard 90‑day window, you may still qualify for an additional 31‑day emergency fill, subject to certain conditions. This safety net can be a lifesaver during a hospital discharge or an unexpected level‑of‑care change.

How To Activate

What you need at the pharmacy

When you step up to the counter, keep these items handy:

- Your Medicare ID card.

- Proof of low‑income status (LIS award letter, Medicaid card, SSI notice).

- Any “best available evidence” (BAE) documents—these could be a recent Social Security award letter or a state Medicaid eligibility notice.

This checklist mirrors the guidance from BenefitsCheckUp.org, which recommends providing BAE to speed up claim processing.

Pharmacy submission steps (LI NET & transition fills)

| Step | Action | Typical codes/fields |

|---|---|---|

| 1 | Hand prescription & Medicare ID to pharmacist | — |

| 2 | Pharmacist submits claim | BIN 015599, PCN 05440000 for LI NET (per BenefitsCheckUp.org) |

| 3 | If denied, request formulary exception or prior‑auth paperwork | — |

| 4 | Keep claim confirmation copy for your records | — |

Timing is everything

Don’t let the clock run out! For LI NET, coverage can be retroactive up to 30 days (or 90 days for dual‑eligible) from the date you present the claim. For a regular transition fill, the window is the first 90 days after you join a new plan. If you switch on Dec 15, your 90‑day clock starts that very day. Mark it on your calendar—missing the window could mean paying out‑of‑pocket or, worse, an interruption in therapy.

Benefits vs. Risks

Benefits you can count on

- Immediate access to essential meds—no dangerous gaps.

- Nationwide pharmacy acceptance—use any pharmacy that accepts Medicare.

- No premium while you’re in the bridge—saves cash for low‑income households.

Potential downsides & mitigation

- Limited duration—Plan ahead. Start your permanent Part D enrollment as soon as you get the temporary supply.

- Possible out‑of‑pocket cost for non‑LIS members—Check if you qualify for a $0‑deductible plan or explore subsidies.

- Formulary gaps may re‑appear—Keep a log of drugs that needed a transition fill. Bring that list to your doctor when you discuss alternatives.

Real‑world tip: a “temporary‑coverage tracker”

Create a simple spreadsheet with columns like: Drug | Original Plan | Transition Date | Supply | Next Step. It’s a tiny habit that pays huge dividends when you’re juggling multiple prescriptions.

Choosing Permanent Plan

Key comparison criteria

- Formulary fit—Does the plan cover every medication you’re already taking?

- Total annual cost—Add premium, deductible, and after‑donut‑hole expenses.

- Utilization‑management policies—How often will you need prior authorizations or step therapy?

Tools & resources (authoritative)

The official Medicare.gov Plan Finder is a free, government‑run tool that lets you filter by your drug list, premium budget, and extra‑help status. State Health‑Insurance Assistance Programs (SHIP) also offer free, unbiased counseling—perfect for a second opinion.

Timeline checklist

| Timeline | Action |

|---|---|

| 0–30 days | Use temporary coverage, gather complete drug list. |

| 30–60 days | Run at least two Plan Finder comparisons. |

| 60–90 days | Contact SHIP, finalize enrollment before temporary supply expires. |

Helpful Resources

When you’re ready to dive deeper, these sources are rock‑solid:

- CMS “Limited Income Newly Eligible Transition (LI NET) Program” fact sheet (2025).

- Medicare Interactive’s guide on transition refills (2025).

- National Council on Aging’s overview of the Part D Transition Policy (2020).

- Your local SHIP office—free, personalized counseling.

All links are embedded naturally within the text, so you can click through whenever you need a quick reference.

Conclusion

Temporary Medicare drug coverage isn’t just a bureaucratic footnote; it’s a lifeline for low‑income beneficiaries and anyone caught between plans. By understanding who qualifies, acting quickly, and using the checklists and tools above, you can avoid costly interruptions and glide smoothly into a permanent Part D plan that suits your needs. If you’ve navigated this bridge before, share your story in the comments—your experience could help a neighbor. And if you have questions, don’t hesitate to reach out to your State SHIP or give your pharmacy a call. We’ve got your back, one prescription at a time.

Leave a Reply

You must be logged in to post a comment.