Most patients don’t realize they can pay as little as $0 per month for Jaypirca when they qualify for the official savings program. Below you’ll find the fastest routes to cut the $8,200‑plus price tag, the pros and cons of each option, and real‑world tips you can start using today – all explained in plain‑English, like a friend sharing a good secret.

Pricing Overview

Current List Price

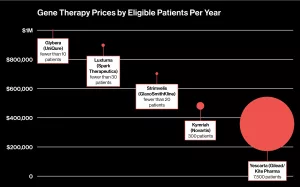

Jaypirca (pirtobrutinib) carries a list price of roughly $8,209 for a 30‑tablet supply when you pay cash, according to the Drugs.com price guide. Insurance can shave a chunk off that number, but many people still face hefty co‑pays, especially if they’re under‑insured or on a high‑deductible plan.

Why Assistance Exists

Specialty oncology drugs like Jaypirca are expensive because they’re brand‑only, require complex manufacturing, and are often used for chronic conditions. Pharmaceutical companies therefore create patient‑assistance programs to close the gap between the sticker price and what most families can actually afford.

Who Should Read This Guide?

If you have commercial insurance, Medicare, Medicaid, are uninsured, or simply want to explore every possible discount, this guide is for you. Caregivers, too, will find the step‑by‑step checklists useful when helping a loved one navigate the paperwork.

Savings Card Details

Eligibility Checklist

- Enrolled in a commercial drug insurance plan that covers Jaypirca.

- Not enrolled in any state, federal, or government‑funded health program (Medicare, Medicaid, VA, etc.).

- Prescribed Jaypirca for an FDA‑approved indication.

- U.S. or Puerto Rico resident, age 18 or older.

How to Enroll & What You Get

Signing up is a breeze: visit the Jaypirca Savings Card page, fill out the short form, and you’ll receive a digital card within a day. Eligible patients can pay as little as $0 per month for a 30‑day supply, with a maximum annual savings of $9,200 and up to 14 prescription fills per calendar year.

Understanding “Maximizer” Plans

A maximizer (or “offset”) plan is a type of insurance design that tries to share the discount you’d get from the savings card with the pharmacy. If your insurer is classified as a maximizer, the card’s benefit may shrink to $25 per month and $350 per year. The best way to know is to call the dedicated line 1‑833‑727‑4589 and ask them to verify your plan.

Real‑World Example

Meet Jane, a 62‑year‑old with commercial coverage. After enrolling, she paid $0 for the first six months. Mid‑year, her insurer flagged a maximizer, dropping her savings to $25 per month. By catching the change early and switching to a non‑maximizer plan during open enrollment, she saved an additional $1,500 that year.

Common Pitfalls & How to Dodge Them

- Forgetting to re‑enroll each year – the card expires on 12/31/2025.

- Trying to stack multiple coupons that conflict with the Savings Card.

- Using the card with a pharmacy that doesn’t honor it; always confirm before you fill.

Discount Cards & Coupons

Drugs.com Discount Card

Even if you’re not eligible for the official Savings Card, the free Drugs.com discount card can shave up to 80 % off the cash price at major chains like Walgreens, CVS, and Walmart. Print the card, present it at checkout, and watch the price drop.

Optum Perks & Pharmacy Coupons

Optum’s online portal lets you enter your dosage, ZIP code, and pharmacy name to generate a printable coupon. The coupons are single‑use and must match your exact prescription strength, but they’re a solid backup when the Savings Card isn’t an option.

NowPatient & Canadian Savings

NowPatient offers an Rx Advantage Card that can reduce costs by up to 90 % for insured patients, plus a Canadian prescription program that can bring the price down to near‑zero for those who can legally import. Eligibility varies, so it’s worth a quick look.

Stacking Rules

Most pharmacies will only apply one discount per fill. However, some allow you to combine a manufacturer coupon with a pharmacy‑wide discount card. The trick is to call ahead, tell the pharmacist you have both, and ask which combination yields the lowest out‑of‑pocket cost.

Step‑by‑Step “Save‑Now” Checklist

- Verify your insurance type (commercial vs. government).

- Register for the official Jaypirca Savings Card if you qualify.

- Download a secondary coupon (Drugs.com, Optum, or NowPatient).

- Call your pharmacy to confirm whether the two can be stacked.

- Keep a copy of all enrollment confirmations for future reference.

Patient Assistance Programs

HealthWell Foundation Copay Program

The HealthWell Foundation offers a copay assistance program for patients with CLL or MCL who meet income criteria (typically ≤ 400 % of the Federal Poverty Level). The program can cover coinsurance, deductibles, and even part of insurance premiums.

Manufacturer‑Sponsored PAP

Lilly runs a free‑of‑charge Patient Assistance Program for uninsured or under‑insured patients. The application asks for proof of income, a recent prescription, and a physician’s attestation that the drug is medically necessary.

How to Apply – Documents Checklist

- Copy of your most recent tax return or pay stub.

- Proof of U.S. residency (driver’s license, utility bill).

- Current prescription for Jaypirca.

- Physician’s signature on the PAP form.

Timeline & Expected Turnaround

Typically, applications are reviewed within 2‑4 weeks. If you need medication urgently, ask the program coordinator about an interim partial assistance option while your full application processes.

Success Story

Mike, a 47‑year‑old freelance graphic designer, lost his job and couldn’t afford his $8,000 monthly bill. After qualifying for the HealthWell Foundation program, he received $7,500 in assistance and only paid $500 out‑of‑pocket for the entire year.

Long‑Term Cost‑Reduction Strategies

Dose Optimization & Therapeutic Monitoring

Talk to your oncologist about whether a dose reduction is possible after you achieve a stable response. Some patients maintain disease control on a lower dose, which can dramatically lower monthly costs.

Future Generics & Biosimilars

At the time of writing, no generic version of Jaypirca exists, but the pipeline is active. Keep an eye on FDA announcements; when a generic hits the market, prices often drop by 70 % or more.

Mail‑Order & 90‑Day Supplies

Many specialty pharmacies offer a 90‑day supply at a discounted rate. If your insurance allows it, ordering a three‑month bundle can save you up‑to‑15 % compared to monthly fills.

Health Savings Accounts (HSA) & Flexible Spending Accounts (FSA)

Pre‑tax dollars from an HSA or FSA can be used to cover co‑pays, deductibles, and even the cost of discount cards. If you have an HSA, consider withdrawing the funds to pay for your Jaypirca fills – it’s money you’d otherwise pay with after‑tax dollars.

Annual Review of Insurance & Assistance Eligibility

Each plan year, sit down with your benefits coordinator or pharmacist and review any new programs that have launched. Insurance plans frequently update their formularies, and a brand‑new patient‑assistance initiative could pop up right when you need it.

Conclusion

Saving on Jaypirca isn’t magic – it’s a series of practical steps you can take right now. Start with the official Jaypirca Savings Card, layer on a reputable discount coupon, explore patient‑assistance programs like the HealthWell Foundation, and keep an eye on long‑term options such as dose adjustments and mail‑order fills. By staying organized and proactive, you’ll keep more of your hard‑earned money for the things that truly matter.

Ready to take the first step? Download our free “Jaypirca Savings Checklist” below, give the Savings Card helpline a call, or chat with your oncology pharmacist today. The sooner you act, the more you’ll keep in your pocket – and the less stress you’ll feel about the cost of treatment.

Leave a Reply

You must be logged in to post a comment.