Plan E was a Medicare supplement (Medigap) option that stopped being available to new Medicare enrollees after 2009.

You cannot buy Plan E today unless you were already enrolled before January 1, 2010. If you had it prior to that cutoff, you may keep it. Because relatively few people still carry Plan E, premiums can be higher than for comparable Medigap options.

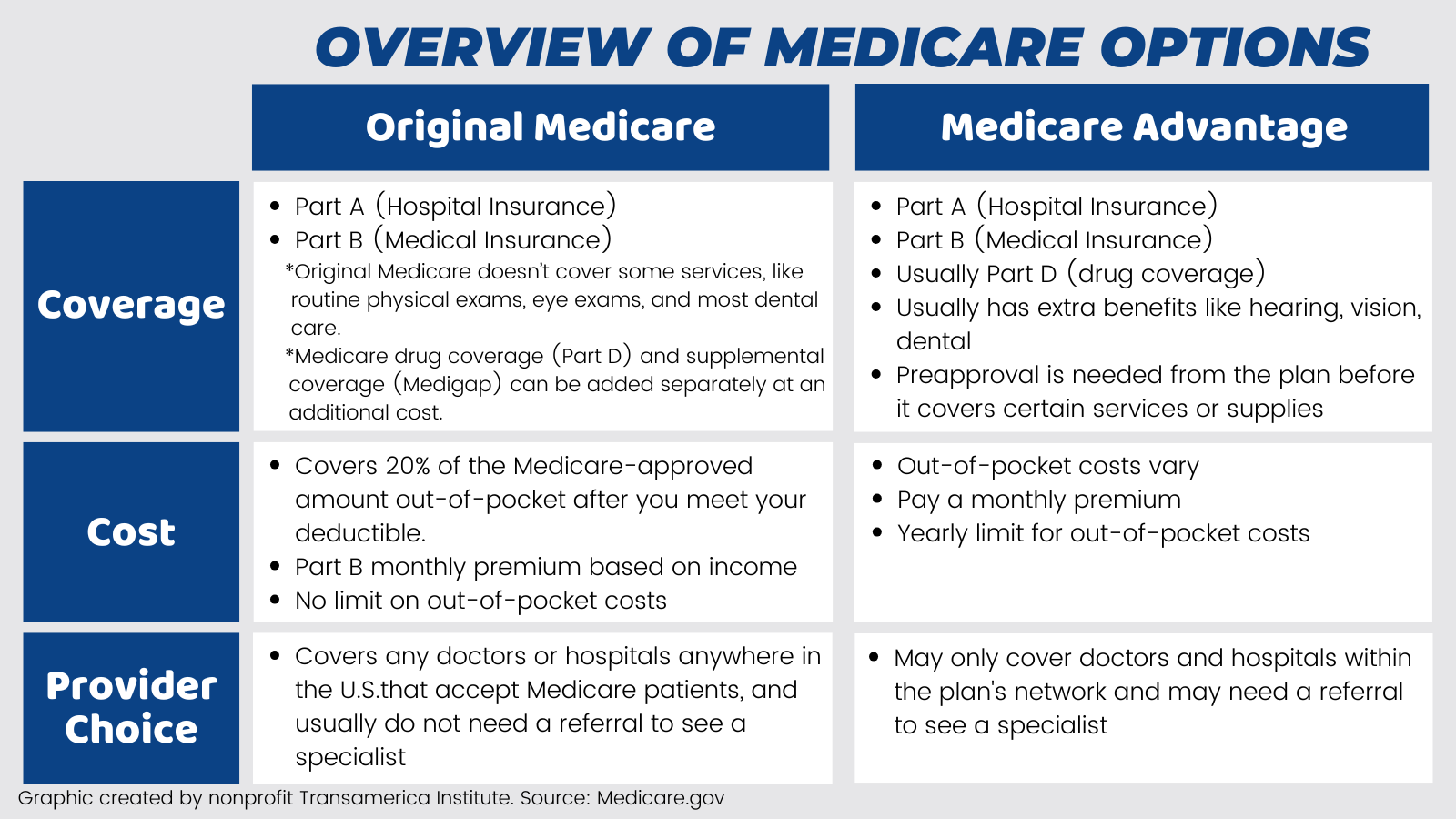

Medicare is the federal health insurance program for people 65 and older and for certain individuals with qualifying disabilities or conditions. It consists of several “parts” — A, B, C, and D — and beneficiaries often add Medigap plans to fill gaps in Original Medicare coverage.

Medigap Plan E, also called Medicare Supplement Plan E, was an add-on to Original Medicare (Parts A and B) that picked up some costs not covered by Medicare. Although new enrollments in Plan E ended in 2010, those who were already covered at that time are allowed to keep their policy.

Glossary of common Medicare terms

- Out-of-pocket cost: The money you pay directly for health care when Medicare does not pay the full amount. This includes premiums, deductibles, coinsurance, and copays.

- Premium: The monthly charge you pay to maintain Medicare or supplemental coverage.

- Deductible: The yearly amount you must pay yourself before Medicare starts to pay for covered services.

- Coinsurance: The percentage of a service’s cost you are liable for after deductible—under Part B, this is commonly 20%.

- Copayment: A fixed fee you pay for certain services or prescriptions when received.

What did Plan E cover in Medigap?

There are 10 standardized Medigap plans currently sold in the market: A, B, C, D, F, G, K, L, M, and N.

Medicare Supplement Plan E was one of the earlier standardized Medigap policies. It paid for certain Medicare Part A and Part B expenses and also provided benefits such as blood transfusions, preventive care (a benefit that newer plans may not include), and coverage for medical care needed while traveling abroad.

The Medicare Prescription Drug, Improvement, and Modernization Act of 2003 brought wide-ranging changes to Original Medicare and how Medigap plans were structured and sold.

That law transformed Medicare + Choice into the Medicare Advantage program (Part C) and established a prescription drug benefit (Part D) delivered through private plans.

The Medicare Improvements for Patients and Providers Act of 2008 introduced additional reforms that affected Medigap offerings. As a result, several older standardized plans — including E, H, I, and J — were phased out for new enrollees.

Beginning June 1, 2010, Plan E was no longer available for new Medicare beneficiaries. Those who had Plan E in place before it was discontinued in 2010 could generally retain their coverage and benefits going forward.

If you first became eligible for Medicare after June 2010, the closest current alternatives to the more comprehensive older plans are options like Plan D and Plan G.

What benefits did Medigap Plan E include?

Medigap Plan E paid for the following Medicare-related costs:

- Part A coinsurance and hospital expenses

- Coinsurance for skilled nursing facility care under Part A

- Part A deductible

- Part B coinsurance or copayments

- Blood transfusions (up to 3 pints)

- Preventive care benefit (a feature not commonly included in newer plans)

- Medical costs incurred during international travel

Plan E did not cover the following expenses:

- Part B deductible

- Part B excess charges

Because Medigap plans are standardized, insurance companies that still have enrollees in Plan E must honor the original Plan E benefit package.

What to do if you currently have Medigap Plan E

After years of Medicare rule changes, Plan E was phased out for new buyers because it overlapped with newer standardized options.

If you remain enrolled in Plan E, it may make sense to evaluate whether switching to a modern Medigap plan would provide equal or improved protections at a better price. Current plans with similar scope include Plan D and Plan G.

You can look up Medigap policies offered where you live with Medicare’s online search tool.

Another route to expand coverage is to consider a Medicare Advantage (Part C) plan instead.

Medicare Advantage

Medicare Advantage plans are an alternative to Original Medicare (Parts A and B) and often include the same basic coverage as Original Medicare. Many Medicare Advantage plans also bundle in prescription drug coverage and may add dental, vision, and hearing benefits.

To compare current Medigap and Medicare Advantage options, use Medicare’s Find a Plan tool.

The bottom line

Medicare Supplement Plan E was a former Medigap option removed from the new-enrollee market in 2010.

Plan E helped pay for core Medicare costs, including some Part A and Part B expenses, blood transfusions, and medical care while traveling abroad.

New beneficiaries cannot enroll in Plan E today, but those who had it before it was discontinued may continue receiving its benefits. If you’re comparing alternatives, you might also review options like medicare set aside arrangements or check related coverage questions such as does medicare cover psa test and does medicare cover genetic testing when considering your overall Medicare strategy.

Leave a Reply

You must be logged in to post a comment.