Hey there! If you’ve ever stared at a Medicare brochure and felt a wave of “what‑on‑earth‑does‑this‑mean?” you’re not alone. In the next few minutes we’ll walk through the most useful Medicare facts—eligibility, enrollment, coverage, costs, and a few surprise twists—so you can make sense of it all without the jargon overload. Grab a cup of coffee, settle in, and let’s demystify Medicare together.

Eligibility Basics

Who Can Sign Up for Medicare?

Medicare isn’t just a senior‑citizen club. While the classic image is “turn 65 and you’re in,” there are three main pathways:

- Age ≥ 65 – the most common route.

- Disability – if you’ve received Social Security Disability Insurance (SSDI) for at least 24 months, you become eligible before 65.

- End‑Stage Renal Disease (ESRD) – anyone with permanent kidney failure needing dialysis or a transplant qualifies, regardless of age.

These rules come straight from the CMS Fact Sheet: Introduction to Medicare. Knowing which bucket you fall into is the first step toward peace of mind.

Real‑world glimpse

Take Maria, who turned 68 last spring. She thought she’d have to wait for “something else” after retirement, but a quick phone call to 1‑800‑MEDICARE confirmed she was automatically eligible. A simple eligibility check saved her months of confusion.

Enrollment Windows

When Should You Enroll?

Medicare has three enrollment periods that matter:

- Initial Enrollment Period (IEP) – 7‑month window that starts three months before your 65th birthday and ends three months after.

- General Enrollment Period (GEP) – Jan 1 to Mar 31 each year if you missed the IEP. Beware of a possible 10% penalty on Part B premiums.

- Special Enrollment Period (SEP) – Available if you’re covered by another group health plan (like through an employer) when you become eligible.

Mark these dates on your calendar now; the cost of missing them can be a real surprise later on.

Step‑by‑step enrollment checklist

- Gather your Social Security number and current health‑insurance info.

- Decide between Original Medicare and a Medicare Advantage (MA) plan.

- Enroll online at Medicare.gov or call 1‑800‑MEDICARE.

- Review your Medicare Summary Notice (MSN) once it arrives.

- Set up automatic premium payments to avoid missed dues.

Coverage Breakdown

What Does Each Part Cover?

Think of Medicare as a four‑piece puzzle that fits together to protect you from most health‑care costs.

| Part | What It Pays For |

|---|---|

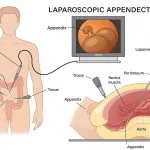

| Part A – Hospital Insurance | Inpatient hospital stays, skilled nursing facility care, hospice, and some home health services. |

| Part B – Medical Insurance | Doctor visits, outpatient care, preventive services, durable medical equipment, and certain vaccines. |

| Part C – Medicare Advantage | All benefits of A & B run through private insurers; often adds vision, dental, hearing, and prescription drug coverage (Part D) in one plan. |

| Part D – Prescription Drugs | Helps pay for prescription medications; plans vary in premiums, formularies, and cost‑sharing. |

The “four‑part” framework is explained in depth by KFF’s Health Policy 101: Medicare. Knowing which piece you need most helps you choose the right combination.

Quick tip

If you love the idea of one‑stop shopping, a Medicare Advantage plan (Part C) can bundle everything—including your drug coverage—into a single premium. Just compare the network and out‑of‑pocket limits before you decide.

Prescription Cost Cap

2025’s $2,000 Out‑of‑Pocket Limit

Good news! Starting in 2025, anyone with Part D coverage will see a hard cap of $2,000 on yearly out‑of‑pocket drug costs. Once you hit that ceiling, you won’t pay copays or coinsurance for the rest of the calendar year.

How it works

- The cap applies only after you’ve met your deductible and any required coinsurance.

- You can choose to spread the cost across monthly payments, a feature highlighted in the 2025 Medicare & You Handbook.

- If you’re on a high‑cost specialty drug, the cap can be a lifesaver—literally.

Real‑world example

John, a 72‑year‑old with arthritis, saw his medication bill surge to $1,800 in June. Thanks to the new cap, he paid nothing beyond that amount for the rest of the year, easing a huge financial strain.

Telehealth Changes

What’s Different in 2025?

Telehealth exploded during the pandemic, and Medicare responded—but with a twist. Until March 31 2025, most services could be delivered to you wherever you are. After that, most non‑mental‑health visits require you to be in a rural medical facility, but mental‑health and behavioral health services can still be accessed from home.

Why it matters

If you rely on virtual visits for therapy or chronic‑condition check‑ins, you won’t lose that convenience—just be mindful of the date. The policy details are laid out in the same handbook we referenced earlier.

Story snippet

Emily, who lives in a small town in Ohio, used tele‑psychiatry to manage her anxiety. Even after the March deadline, she still gets her weekly sessions at home because mental‑health care stays covered nationwide.

Mental Health Benefits

Expanded Coverage in 2025

Medicare’s mental‑health umbrella has widened. Now you can receive services from:

- Marriage and family therapists

- Mental‑health counselors

- Intensive outpatient programs (IOP) in select locations

During your annual “Wellness” visit, providers can also conduct a health‑risk assessment that flags social‑needs and connects you to these new supports. This update comes straight from the 2025 handbook.

Quick anecdote

When Sam’s wife was diagnosed with depression, they thought Medicare wouldn’t help. A quick call to their primary care doctor revealed coverage for family counseling—saving them both time and money.

Caregiver Support

Resources You May Not Know About

Being a caregiver is a full‑time job, and Medicare now offers:

- Free training programs to improve caregiving skills.

- Financial relief while caring for a loved one in hospice.

- A pilot program for dementia caregivers that provides added counseling and respite.

All of these are highlighted in the handbook’s caregiver section. If you’re shouldering that load, you deserve these supports.

Personal note

My aunt’s son, who cares for her Alzheimer’s progression, told me the caregiver‑training webinars gave him confidence to manage medication schedules—something he never thought Medicare would touch.

Advantage Growth

Why More People Choose Medicare Advantage

In 2024, 54 % of Medicare beneficiaries were enrolled in a private Medicare Advantage (MA) plan, according to KFF’s latest enrollment update. By 2033, projections suggest roughly two‑thirds will be in MA plans.

Pros and cons

- Pros: Extra benefits (vision, dental, hearing), often lower out‑of‑pocket maximums, coordinated care.

- Cons: Network restrictions, potential prior‑authorization hassles (nearly 50 million requests in 2023 alone, per KFF).

Choosing wisely

If you value flexibility and don’t mind staying within a plan’s network, MA can be a great value. If you travel a lot or need very specific specialists, Original Medicare plus a Medigap policy might be safer.

Common Myths

“Medicare Covers Everything” – Not Quite

It’s a common belief that once you have Medicare, you’re set for life. In reality, there are notable gaps:

- Dental, vision, and hearing services are generally not covered under Original Medicare.

- Long‑term custodial care (e.g., assisted‑living) is excluded.

- Premiums, deductibles, and copays still apply—even with supplemental coverage.

Myth‑busting table

| Myth | Reality |

|---|---|

| “No out‑of‑pocket costs.” | Beneficiaries still pay premiums, deductibles, and coinsurance. Medigap can help, but it’s an extra expense. |

| “All doctors accept Medicare.” | Some doctors opt out; always verify a provider’s participation status. |

| “Medicare automatically covers prescriptions.” | Only Part D or a Medicare Advantage plan with drug coverage does. |

Friendly reminder

Before you sign up for anything, ask: “What am I still paying for?” that simple question can uncover hidden costs you might otherwise miss.

Fraud Protection

How to Spot and Report Medicare Fraud

Scammers love the Medicare brand because it’s trusted. Here are red flags to watch for:

- Unsolicited phone calls claiming you owe money or need personal info.

- Emails with suspicious attachments that ask you to verify your SSN.

- Offers for “free” medical equipment that never arrive.

If anything feels off, you can report it directly on Medicare.gov’s fraud‑reporting page. Acting quickly can protect both you and other beneficiaries.

Case in point

Linda received a call from someone posing as a “Medicare agent” asking for her bank details. She hung up and filed a report online—a move that likely saved her from identity theft.

Putting It All Together

We’ve covered a lot of ground, but here’s the TL;DR version to keep in your pocket:

- Check if you meet Medicare eligibility (age, disability, ESRD).

- Mark the enrollment windows—don’t let a missed deadline cost you extra.

- Know the four parts (A, B, C, D) and decide whether Original Medicare or a Medicare Advantage plan fits your lifestyle.

- Take advantage of the 2025 $2,000 prescription‑drug cap.

- Use telehealth wisely; mental‑health services stay home‑friendly.

- Explore new mental‑health and caregiver resources for added support.

- Weigh the rapid growth of Medicare Advantage against its network limits.

- Debunk myths—understand what Medicare doesn’t cover.

- Stay alert for fraud and report suspicious activity.

Next Steps for You

Feeling a little less overwhelmed? Great! Here’s a quick action plan you can follow right now:

- Download the free enrollment checklist (you can create it from the steps above).

- Visit Medicare.gov to compare plans in your zip code—spend about 15 minutes, and you’ll see premium estimates, star ratings, and drug formularies.

- Talk to a local Medicare counselor (many senior centers host free sessions).

- Share this article with a friend or family member who’s approaching eligibility. Knowledge is power, after all.

Remember, Medicare is a tool—not a trap. The more you understand the facts, the better you can shape it to serve your health goals. If you have questions, drop a comment below or reach out to your local Medicare office. We’re all in this together, and I’m glad we could navigate these Medicare facts side by side.

Leave a Reply

You must be logged in to post a comment.