Hey there! If you’ve ever blinked at a pharmacy receipt and wondered why the numbers look like a secret code, you’re not alone. The Medicare drug price list isn’t just a boring spreadsheet—it’s the key that can unlock big savings on the medicines you need. In the next few minutes, I’ll walk you through what the list actually is, how recent law changes are reshaping prices, and a handful of practical steps you can take right now so your next prescription doesn’t break the bank.

What Is It?

Put simply, the Medicare drug price list is the collection of prices the government uses when it calculates what you’ll pay under a Part D plan. Think of it as the menu at a restaurant, except the dishes are drugs, the “menu price” is the list price, and the “special of the day” is whatever discount or negotiation came into play. The list shows each drug’s National Drug Code (NDC), the standard 30‑day list price, and—if a negotiation has happened—the Maximum Fair Price (MFP) that Medicare is allowed to pay.

Why does this matter? Because your out‑of‑pocket cost is a mix of the plan’s deductible, your co‑pay or coinsurance, and what the plan actually pays the pharmacy. The price list is the foundation of that calculation, and understanding it can help you predict—and often lower—your CMS negotiated prices for high‑cost medicines.

How Prices Are Set

Before the Inflation Reduction Act (IRA) of 2022, Medicare was stuck watching drug manufacturers set list prices and then negotiating secret rebates that nobody really knew about. The IRA handed the Centers for Medicare & Medicaid Services (CMS) a brand‑new power: the ability to directly negotiate prices for certain single‑source drugs that have no generic competition.

The process looks a bit like a friendly game of “who can offer the better deal?”:

- Initial offer: CMS proposes a price based on factors like the drug’s clinical value, existing market price, and the government’s budget impact.

- Counter‑offer: The drug maker replies, often with data on research costs or patient‑access programs.

- Negotiation meetings: Usually three rounds of meetings where both sides tweak numbers and share evidence.

- Final agreement: When they land on a number, CMS files it as the Maximum Fair Price (MFP) that will apply for the “price applicability year.”

According to a CMS fact sheet, the very first round of negotiations (2026) covered ten high‑expenditure drugs and resulted in a combined saving of roughly $6 billion for the Medicare program and $1.5 billion for beneficiaries.1

2026‑2027 Changes

Now for the juicy part—what actually changed in the price list starting in 2026? Below is a quick snapshot of the ten drugs that were negotiated, showing the dramatic drop from their 2023 list prices to the new MFPs.

| Drug (Brand) | 2023 List Price (30‑day) | Negotiated MFP (2026) | Typical Out‑of‑Pocket Impact |

|---|---|---|---|

| Eliquis | $521 | $231 | Potential $150‑$200 savings per year |

| Xarelto | $517 | $197 | Similar $150‑$200 drop |

| Januvia | $527 | $113 | About $300 less annually |

| Jardiance | $573 | $197 | Nearly $400 saved each year |

| Enbrel | $7,106 | $2,355 | Massive $4,500+ reduction |

| Imbruvica | $14,934 | $9,319 | Over $5,000 saved for cancer patients |

| Farxiga | $556 | $178 | More than $300 saved |

| Entresto | $628 | $295 | Nearly $350 less |

| Stelara | $13,836 | $4,695 | Saved $9,000+ annually |

| Fiasp / NovoLog | $495 | $119 | About $380 saved |

These numbers aren’t just theory—they’re concrete reductions that will appear on your next pharmacy receipt (once your plan applies the new MFP). The second negotiation cycle for 2027 is already in motion, and CMS expects to add more drugs each year, with inflation‑adjusted updates to keep pace.

Use The List

Knowing the price list is only half the battle; the real win comes from applying it to your own prescription bill. Here’s a step‑by‑step cheat sheet you can follow the next time you’re picking up meds:

Step 1 – Find Your Plan’s Formulary

Most Part D plans publish a formulary PDF (for example, Express Scripts Medicare’s 2025 formulary). Search the PDF for the drug’s name or NDC. The formulary will tell you whether the drug is covered, any prior‑authorization requirements, and the tier (which influences co‑pay).

Step 2 – Match the NDC to the Medicare List

Grab the NDC from your prescription label, then locate that same NDC in the CMS negotiated price file (available as a ZIP download). If the drug appears, you’ll see the MFP next to the list price.

Step 3 – Calculate Your Estimated Cost

Use this simple formula:

Estimated Patient Cost = (MFP × Coinsurance %) + Applicable Deductible Portion

For example, if your plan’s coinsurance is 20 % and you’ve already met the deductible, a 30‑day supply of Jardiance at the negotiated $197 MFP would cost about $39 out‑of‑pocket.

Step 4 – Cross‑Check With Your Pharmacy

When you pick up the prescription, compare the pharmacy’s price to your estimate. If there’s a big discrepancy, call the pharmacy or your plan’s customer service. Often the mismatch is due to a lag in updating the MFP file, and they’ll correct it on the spot.

Real‑World Example

Meet Maria, a 68‑year‑old retired teacher with type 2 diabetes. She takes Januvia and the combination insulin Fiasp/NovoLog. Before the 2026 negotiations, her annual out‑of‑pocket for these two drugs was roughly $1,200. After mapping the NDCs to the new MFPs ($113 for Januvia, $119 for Fiasp/NovoLog), and applying her plan’s 20 % coinsurance, her projected annual cost dropped to about $470—a savings of $730! Maria told me she could finally afford a short vacation she’d been postponing for years.

Tips To Save

Even with negotiated prices, there are extra levers you can pull to make your medication budget friendlier.

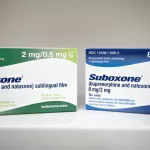

Ask About Generics or Therapeutic Alternatives

If a brand‑name drug appears on the price list but a generic version exists, the generic price is usually far lower. Don’t be shy—ask your doctor or pharmacist if a therapeutic alternative works for you.

Consider a Medicare Advantage (Part C) Plan

Many Advantage plans negotiate their own “closed‑network” contracts that can further drive down costs. Look at a plan’s drug pricing summary before enrollment; sometimes the combined premium + drug cost is cheaper than a standard Part D plan.

Use Manufacturer Assistance Programs

Big pharma often runs patient‑assistance or co‑pay reduction programs. A quick search on the manufacturer’s website (or ask your pharmacist) can net you a $50‑$100 monthly discount, especially for high‑cost biologics like Enbrel or Stelara.

Stay Informed About Annual Updates

The Medicare drug price list isn’t static. Every year around October, CMS releases an updated ZIP file with new MFPs and inflation‑adjusted prices. Mark your calendar and sync the file with your personal spreadsheet or an online calculator.

Leverage the Coverage Gap (Donut Hole) Strategically

If you’re nearing the “donut hole,” consider switching to a plan with a lower gap coverage rate or using a 90‑day supply (where allowed) to push your total spending past the gap faster, thereby unlocking catastrophic coverage sooner.

Wrapping It Up

Understanding the Medicare drug price list is a bit like learning the secret handshake of the pharmacy world. Once you’ve got the basics—what the list is, how the new negotiation program reshapes prices, and the practical steps to match your prescriptions to those numbers—you’ll feel a lot more in control of your Part D costs.

Remember, the good news is that the government is actively pulling down prices on some of the most expensive drugs, and that momentum is only picking up. By staying curious, checking the latest CMS files, and using the simple cheat sheet above, you can turn what once felt like a maze into a clear, manageable path to savings.

What’s your experience with Medicare drug pricing? Have you already seen a drop in your out‑of‑pocket bill after the 2026 changes? Share your story in the comments, and let’s keep the conversation going. If you have any questions, feel free to ask—I’m here to help you navigate the world of prescription costs with confidence.

Leave a Reply

You must be logged in to post a comment.