You’ve probably opened a piece of mail that says “This is NOT a bill” and thought, “What on earth is this?” That’s your Medicare Explanation of Benefits, or EOB for short. In the next several minutes we’ll walk through exactly what an EOB is, why it lands in your mailbox (or inbox), and how you can read it without feeling lost. Think of this as a friendly coffee‑chat – I’ll share the basics, a few real‑world stories, and some handy tricks so you never get caught off guard by a surprise charge again.

What Is an EOB?

Definition & Purpose

An Explanation of Benefits (EOB) is a summary from your Medicare plan that tells you how a claim was processed. It’s not a bill; it’s a detailed receipt that shows what the provider charged, what Medicare allowed, what the plan paid, and what you might still owe. In plain English, it’s the “receipt” you get after a doctor visit, lab test, or prescription fill.

Who Sends It?

For Medicare Advantage (Part C) or Part D prescription plans, the plan itself sends the EOB. Original Medicare (Parts A & B) sends a similar document called a Medicare Summary Notice (MSN), but we’ll focus on the EOB you receive from your plan. According to the official Medicare guide, each month you should get one unless you had no claim activity.

Frequency & Delivery

Most plans deliver an EOB monthly, but some send one every time a claim is processed and then a quarterly summary. You can usually choose paper or electronic delivery. Going paperless not only helps the environment, it lets you spot errors faster because the online portal often has a search function.

Paper vs. Online Delivery

| Aspect | Paper | Online |

|---|---|---|

| Speed | Arrives by mail (1–2 weeks) | Usually within 24‑48 hours |

| Storage | Physical filing needed | Secure digital archive |

| Searchability | Manual skim | Keyword search & download |

| Eco‑friendliness | Uses paper | Paper‑free |

Reading an EOB

Header Information

The top of the EOB lists your name, Medicare ID, plan name, and a claim number. This is your reference if you need to call the plan’s member services – the number is usually right under the header.

Service Details

Below the header you’ll see:

- Date of Service – when the care happened.

- Provider Information – name, address, and sometimes the National Provider Identifier (NPI).

- Service Description – what you actually received (e.g., “Office visit – CPT 99213”).

Money Columns

These are the parts that make most people pause:

- Provider Charges – what the doctor or pharmacy billed you.

- Allowed Charges – the maximum amount Medicare will consider payable for that service.

- Paid by Insurer – the portion your plan covered.

- Patient Responsibility – what you may owe after the plan’s payment (deductible, copay, coinsurance).

Notice the phrase “What You Owe” or “Patient Balance.” That amount is what you should expect on a separate bill from the provider, if anything.

Remark & CARC Codes

At the bottom you’ll often see two‑letter codes like “PDC” or “CO‑16.” These are remark codes (sometimes called CARC codes) that explain why a charge was reduced, denied, or adjusted. A quick web search of the code (or a call to member services) tells you whether the plan applied a discount, an annual limit, or a billing error.

Deductible & Maximum Out‑of‑Pocket (MOOP)

Many EOBs include a small box that shows how much of your yearly deductible you’ve met and where you stand relative to the plan’s MOOP limit. Once you hit the MOOP, the plan pays 100 % of covered services for the rest of the year.

Sample EOB Snapshot

Imagine a redacted snippet that looks like this:

Date of Service: 03/15/2024Provider: Dr. Smith, Family MedicineService: Office Visit (CPT 99213)Provider Charges: $150.00Allowed Charges: $115.00Paid by Insurer: $92.00Patient Responsibility: $23.00 (Co‑pay)Remark Code: PDC – Billed amount exceeds allowed amount.Deductible YTD: $150 of $800MOOP YTD: $92 of $4,500

Seeing those numbers side‑by‑side makes it clear that you owe a modest $23, and you’re still far from hitting your deductible.

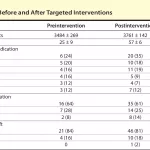

Advantage vs. Original

Key Visual Differences

Medicare Advantage (MA) EOBs tend to be more colorful and include extra sections for Part D drug claims, supplemental benefits, and the MOOP tracker. Original Medicare’s MSN is more stripped‑down, showing only the basic allowed amount and your patient responsibility.

When You Won’t Receive an EOB

According to the Centers for Medicare & Medicaid Services (CMS), you won’t get an EOB if:

- You had no claim activity during the reporting period.

- You’re a dual‑eligible beneficiary (Medicare + Medicaid), because the Medicaid system usually handles the paperwork.

Part D Prescription EOBs

Drug plans send a separate EOB that focuses on pharmacy fills. It lists “Pharmacy Paid” instead of “Provider Paid,” and often includes the formulary tier (generic, brand, specialty). The layout mirrors medical EOBs but swaps the provider column for the pharmacy name.

Comparison Table

| Feature | Medicare Advantage EOB | Original Medicare (MSN) |

|---|---|---|

| Sender | Plan (C or D) | CMS (Federal) |

| MOOP Display | Yes, with progress bar | No (MOOP not applicable) |

| Drug Claims | Integrated or separate | Separate MSN for Part D |

| Frequency | Monthly or per‑claim | Quarterly |

Common Issues

Mistakes You Might Spot

It’s not uncommon to see a duplicate line, a date that’s off by a day, or a service you never received. A quick scan for “Provider Charges” that don’t match your receipts can save you from paying an extra $200 or more.

Denied Claims

If the EOB says “Denied” and shows a reason code (e.g., “CO‑16 – Insufficient documentation”), don’t panic. Most denials are fixable: you can supply the missing paperwork, request a correction, or appeal the decision.

How to Appeal

The appeal process typically follows these steps:

- Call the member services number on the EOB within 60 days.

- Ask for a written explanation of the denial and any needed forms.

- Submit the appeal with supporting documents (doctor’s note, prescription, etc.).

- If the plan denies the appeal, you can request a second‑level review through your State Health Insurance Assistance Program (SHIP). SHIP resources are free and can guide you through the paperwork.

Suspected Fraud

Sometimes a charge looks completely out of left field—like a $1,500 MRI you never had. In that case, report it immediately. You can call 1‑800‑MEDICARE (1‑800‑633‑4227) or the Medicare Drug Integrity Contractor at 1‑877‑7SAFERX. Most plans also have a fraud hotline printed on the EOB.

Mini‑Checklist Before Paying

- Do the dates match my records?

- Are the provider names correct?

- Is the amount I’m being asked to pay consistent with my receipt?

- Is there a denial or remark code I don’t understand?

- Have I kept the EOB for at least a year for tax or audit purposes?

Tracking Claims

Set Up Online “Paperless”

If your plan offers an online portal (most do), sign up today. You’ll receive an email alert every time a new EOB lands, and you can download PDFs for your records. Blue Cross Blue Shield of Michigan, for example, lets you toggle “Paperless Options” with a couple of clicks.

Personal Claims Log

Even with an online portal, I love keeping a simple spreadsheet. Here’s a starter layout you can copy:

| Date | Provider | Service | Billed | Allowed | Paid | Patient Owe | Deductible YTD | MOOP YTD |

|---|---|---|---|---|---|---|---|---|

| 03/15/2024 | Dr. Smith | Office Visit | $150.00 | $115.00 | $92.00 | $23.00 | $150 | $92 |

Updating this after each claim gives you instant insight into how close you are to meeting your deductible or hitting the MOOP limit.

Monitoring Deductible & MOOP Progress

Every EOB typically shows a tiny box like “Deductible YTD: $300 of $800.” Keep an eye on that number; once you’ve paid the full deductible, your plan starts covering a larger share of services (often 80 % or more). The same goes for the MOOP – after you hit it, you won’t owe anything else for covered care that year.

Expert Tips

Quote from a Medicare Counselor

“Most seniors never look at their EOBs, and they end up paying for services that were actually covered,” says Maria Hernandez, a certified SHIP counselor. “A quick five‑minute review can catch errors that might otherwise cost hundreds of dollars.”

Data Point

Recent CMS data shows that 31 % of Medicare beneficiaries never review their EOBs, leading to higher out‑of‑pocket spending. That’s a big opportunity for you to save money simply by paying attention.

Recommended Resources

- Official Medicare EOB guide

- CMS guide on reading EOBs

- State Health Insurance Assistance Programs (SHIP)

Conclusion

Understanding your Medicare Explanation of Benefits isn’t just bureaucratic jargon – it’s a powerful tool that helps you see exactly what your plan paid, what you owe, and where mistakes might be hiding. By taking a few minutes each month to scan the header, service details, money columns, and remark codes, you protect yourself from surprise bills, stay on top of your deductible, and make smarter health‑care choices.

So, grab the latest EOB you have on hand, run through the quick‑checklist we shared, and consider signing up for paperless delivery if you haven’t already. You’ll feel more in control, and your future self will thank you when the next claim comes through.

Got a story about an EOB that saved you money, or a question that’s still nagging? Share it in the comments below – we’re all in this together!

Leave a Reply

You must be logged in to post a comment.