Quick Answer Snapshot

If you’ve ever wondered whether Medicare will pick up the cost of Avara (the brand name for leflunomide), the short answer is: yes, it can – but only if your prescription is part of a Medicare Part D or a Medicare Advantage plan that includes drug coverage. The exact out‑of‑pocket amount you’ll pay depends on your plan’s formulary tier, deductible, and any extra‑help programs you qualify for. In a nutshell, you might pay anywhere from a few dollars a month to a few hundred, so it’s worth digging into the details.

Why Avara Matters

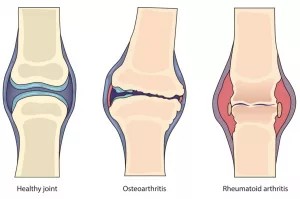

Avara is a disease‑modifying antirheumatic drug (DMARD) that contains the active ingredient leflunomide. For people living with rheumatoid arthritis (RA), it can shrink painful swelling, protect joints, and keep you moving without those stiff, achy mornings that feel like you’ve been dragged through a sandstorm. But the medication isn’t cheap, and many seniors find themselves staring at the bottle, wondering if the price is justified.

Here’s a quick story. My neighbor, Linda, turned 68 last year and was finally diagnosed with RA after years of “just getting older.” Her rheumatologist prescribed Avara, and it worked wonders—her joint pain dropped dramatically. The catch? Her original Medicare Part D plan listed leflunomide on a high Tier 4, meaning a 30‑percent coinsurance after the deductible. That translated to nearly $900 a year out‑of‑pocket. After switching to a Medicare Advantage plan with a $0 premium, Linda’s cost fell to about $600. The difference? A little extra paperwork and a phone call to her doctor’s office, but the relief felt worth every minute.

Medicare Parts Overview

Part D Prescription Drug Plans (PDP)

Part D plans are stand‑alone drug plans you can add to Original Medicare (Parts A & B). They each have a formularies—lists of covered drugs—organized into tiers. Most leflunomide listings sit in Tier 3 or Tier 4, meaning you’ll face a deductible first and then a coinsurance of roughly 25‑30 %.

Medicare Advantage (MA) with Part D (C + D)

MA plans bundle hospital, medical, and drug coverage into one package. Many of these plans, especially those with $0 premiums, still include leflunomide on their formularies—sometimes on a lower tier because the plan negotiates better rates with the pharmacy benefit manager. For example, in Avera, Georgia, the average MA premium is $14.41 per month with a maximum out‑of‑pocket (MOOP) of $6,638 (source: Fair Square Medicare).

Coverage Gap (Donut Hole) & Catastrophic Phase

Once you and your plan have paid a certain amount of drug costs, you enter the coverage gap where you generally pay 25 % of the drug price until you hit the catastrophic threshold. After that, you only pay a small copay, sometimes as low as $5 per prescription.

Sample Cost Flow Chart

| Phase | What You Pay for Avara | Typical Cost for a 30‑day Supply* |

|---|---|---|

| Deductible | 100 % of price | $250‑$350 |

| Initial Coverage | Coinsurance (≈25 %) | $60‑$90 |

| Coverage Gap | Coinsurance (≈25 %) | $60‑$90 |

| Catastrophic | Low copay (≈$5‑$10) | <$10 |

*These numbers are illustrative; actual amounts vary by plan and region.

Out‑of‑Pocket Costs

Factors That Influence Your Bill

Several moving parts affect how much you’ll actually spend on Avara:

- Plan premium – Higher premiums can mean lower drug coinsurance.

- Deductible – Some plans have $0 drug deductibles, others require $100‑$200 before coverage kicks in.

- Formulary tier – Tier 3 usually means 25 % coinsurance; Tier 4 can be 30‑35 %.

- IRMAA – If your income is above a certain threshold, you’ll pay higher Part B premiums, which indirectly affects overall affordability.

Comparing Typical Plans

| Plan type | Avg. monthly premium | Avara tier | Estimated annual OOP* |

|---|---|---|---|

| Standard PDP | $15‑$30 | Tier 3 | $800‑$1,200 |

| $0‑premium MA (e.g., AvMed) | $0 | Tier 4 | $1,200‑$1,800 |

| High‑benefit MA (GA average) | $14.41 | Tier 3 | $600‑$900 |

*Figures are based on 2025 CMS data and local plan listings; see the CMS Part D pricing report for the latest numbers.

Strategies to Lower Your Out‑of‑Pocket (OOP)

Here are a few practical tricks you can try right now:

- Shop MA plans during the Annual Election Period (AEP) – many offer $0 premiums and lower tiers for leflunomide.

- Apply for Extra Help if your income qualifies; it can wipe out Part D premiums, deductibles, and coinsurance (a lifesaver for seniors on fixed incomes).

- Ask your doctor about dose adjustments or alternative DMARDs that sit on a lower tier—sometimes a slight tweak keeps you on the same drug but cuts costs.

- Use pharmacy discount cards or manufacturer copay assistance programs (leflunomide has limited manufacturer assistance, but local charities may help).

Enroll & Verify Steps

Getting Avara covered is a bit like assembling a puzzle—each piece needs to fit. Follow these steps to make sure you’re set:

- Confirm diagnosis – Your medical record must show rheumatoid arthritis; this is the foundation for “medical necessity.”

- Check the formulary – Log into the Medicare Plan Finder or your plan’s website and verify that leflunomide (Avara) appears on the list. Look for the exact brand name, not just the generic.

- Choose the right enrollment window – The AEP runs from October 15 to December 7 each year. If you’re newly diagnosed, you may qualify for a Special Enrollment Period (SEP).

- Submit a Letter of Medical Necessity (optional but recommended) – A brief note from your rheumatologist stating why leflunomide is essential can smooth the approval process.

- Finalize enrollment – Fill out the enrollment form, double‑check your pharmacy address, and keep a copy of the confirmation.

Tools & Resources

When you’re ready to compare plans, the CMS Medicare Plan Finder is the gold standard. It lets you filter by drug coverage, premium, and star rating, so you can see at a glance whether Avara is on‑formulary.

Common Questions Answered

Below are quick, bite‑size answers to the most frequent queries about Avara and Medicare. If you’re scanning for a specific detail, you’ll find it here in a single sentence.

- Does Medicare always cover Avara? Only if the drug is listed on your plan’s formulary and a physician certifies it’s medically necessary.

- What tier is leflunomide usually? Most Part D plans place it in Tier 3 or Tier 4.

- Can a Medicare Advantage plan make Avara cheaper? Often—especially $0‑premium MA plans that negotiate lower tier placements.

- What is “Avara out‑of‑pocket”? The total amount you pay yourself for the drug after deductibles, coinsurance, and any copays.

- How does “Extra Help” affect cost? It can reduce or eliminate Part D premiums, deductibles, and coinsurance, potentially dropping your annual OOP to under $100.

Real World Cases

Case Study A – Linda, 68, Georgia

Linda was on a standard Part D plan that listed leflunomide in Tier 4 with a $150 deductible. Her annual cost for Avara alone was $1,200. After reviewing her options during the AEP, she switched to a $0‑premium Medicare Advantage plan (AvMed Medicare One). The plan placed leflunomide on Tier 3, and her annual out‑of‑pocket dropped to $600. She says, “I saved enough to splurge on a weekend getaway—something I thought I’d never afford again.”

Case Study B – Carlos, 72, Ohio

Carlos stayed with his original PDP because he liked the network. His OOP for Avara was $1,400. When his income qualified him for the Extra Help program, his Part D premium vanished, the deductible fell to $0, and his coinsurance dropped to 15 %. His new annual cost fell to $300. Carlos now recommends the program to every friend: “If you think you’re too busy to apply, trust me—your wallet will thank you.”

Bottom Line Summary

In a nutshell, Avara (leflunomide) can be covered by Medicare, but the price tag you’ll see on your bill varies wildly based on the plan you pick, the tier it sits on, and whether you qualify for assistance programs. The key is to:

- Check the formulary before you enroll.

- Consider a Medicare Advantage plan with a $0 premium if it offers a lower tier.

- Apply for Extra Help if you’re eligible.

- Talk to your rheumatologist about a Letter of Medical Necessity.

Take a few minutes this week to log into the Medicare Plan Finder, compare a couple of options, and maybe call your doctor’s office to confirm that leflunomide is listed as medically necessary. The effort can shave off hundreds of dollars from your yearly drug bill.

What’s your experience with Avara and Medicare? Have you found a plan that works like a charm, or are you still searching for the right fit? Drop a comment below or reach out—your story could help someone else navigate this maze. Remember, we’re all in this together, and the right coverage can make living with rheumatoid arthritis a lot less painful.

Leave a Reply

You must be logged in to post a comment.