Price Changes Stirring Things Up

Let’s get straight to it, because honestly—there’s no other way to talk about health costs. Are you feeling it, too? The way little price bumps start to sneak up, especially when you’re juggling diabetes expenses? It’s not just a number on a paper. The new medicare part b premium 2025… well, it’s a change that’ll hit home if you rely on Medicare to help manage diabetes—or honestly, any chronic thing that has you visiting the doctor a little more often than you’d like.

We all know how fast the “health stuff” snowballs. One blood test becomes three, that routine check-in means three bills, and if you’re anything like my neighbor Dee—who swears by her glucose monitor but sighs every time a new billing statement arrives—it can feel, some months, like your wallet is on a strange diet, too.

So, What’s Changing About Part B?

Here’s the headline: for 2025, the standard Medicare Part B monthly premium jumps to $185. That’s up from last year’s $174.70. It’s not a massive increase, but—it’s enough to notice, especially if you’re living on a fixed income or Social Security check.Medicare’s own announcement chalks this up to expected increases in service use and the steady march of medical prices. (Don’t you wish the prices marched backward for a change?)

And if you’re wondering about 2026… let’s just say, keep an eye on that future Medicare Part B premium 2026 page. History says: what goes up, usually keeps going up… sigh.

Snapshot: Key Numbers

| Year | Standard Part B Premium | Deductible |

|---|---|---|

| 2024 | $174.70 | $240 |

| 2025 | $185.00 | $257 |

Okay, numbers done (for now). But what do these new digits actually mean if diabetes is on your health menu?

Why Diabetes Makes This Premium a Big Deal

Let’s get personal for a sec—because if you’re reading this for yourself, or someone close, you probably know: diabetes isn’t “just” a diagnosis. It’s a routine. A steady stream of supplies, check-ups, diabetes education classes, lab tests, podiatrist visits, and don’t even get me started on the endless need for test strips, monitors, and insulin.

Here’s the thing: Medicare Part B is what helps cover the costs for a whole bunch of that. Blood sugar meters? Check. Continuous glucose monitors? Yep. Outpatient visits? Most of those, too.Here’s a handy summary from Medicare.

So, if your premium is on the rise, you’re basically paying an extra monthly “membership fee” to access all this coverage. It doesn’t matter if you use it once or a hundred times; that fee comes out either way. And honestly, for most of us managing diabetes, the supplies alone make Part B totally worth it… but that doesn’t mean it stings any less to see it climb.

How Part B Premiums Play Out in Real Life

Let me tell you about my friend Tom (with permission!). He’s 67, retired early because of his diabetes complications, super diligent about his health. He says the premium hike last year made him pause and rethink some of his monthly “extras”—cutting out a couple of streaming services and his beloved weekly bagel stop. Small stuff, but “it adds up if you’re not watching,” he laughs. Still, for Tom, keeping his continuous glucose monitor and nurse check-ins was non-negotiable. “No premium hike is as costly as a week in the hospital,” he jokes—maybe a little too grimly, but he’s right.

Quick Reality Check

If you have diabetes and want to use Medicare for things like: testers, strips, lancets, insulin delivered by pump, yearly eye exams, education classes, and more—you need to have Part B. Medicare part b premium 2025 isn’t just for “emergencies.” It’s your “stay healthy, stay home, avoid ER” ticket.

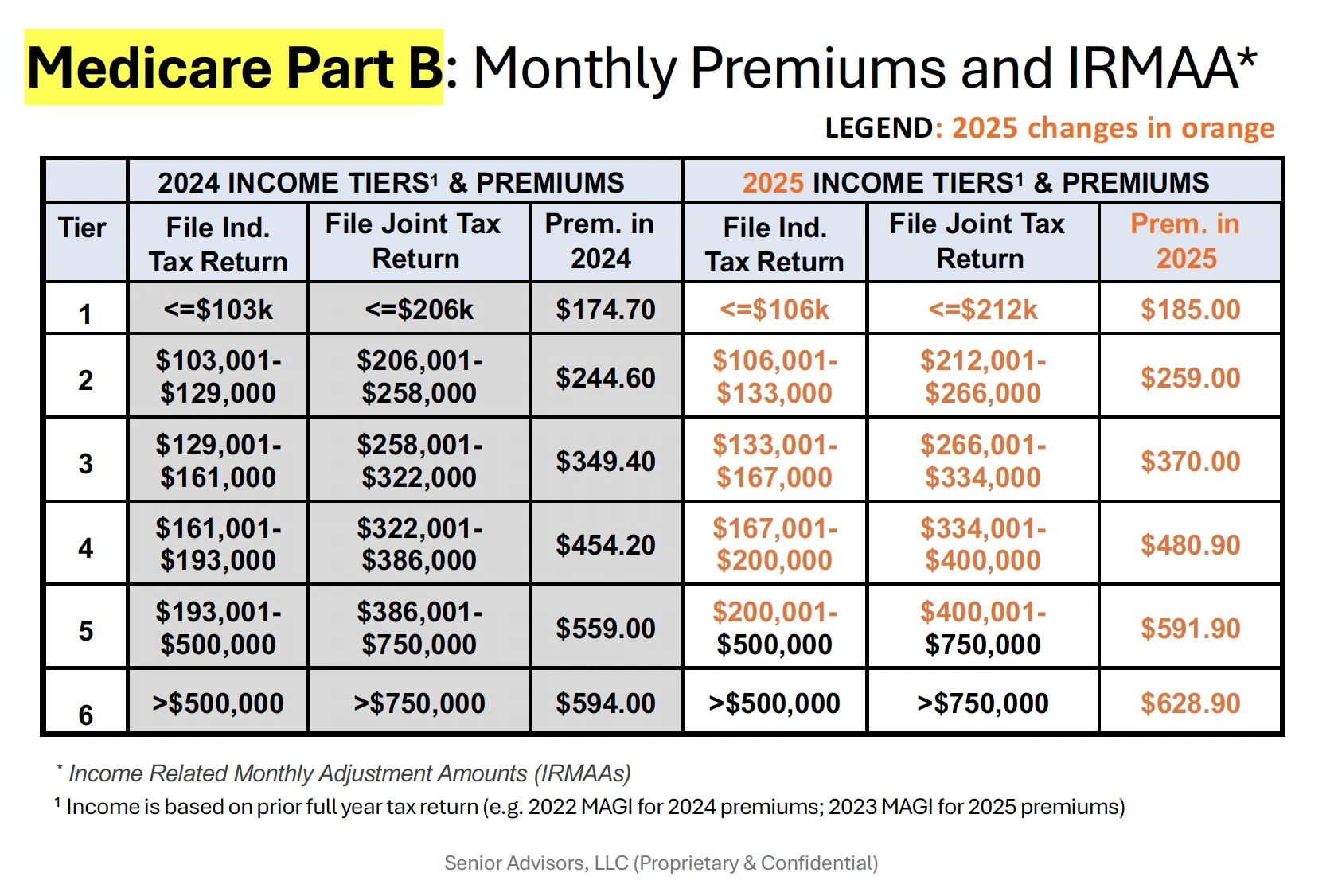

Does Your Income Make It Higher?

Here’s where things get… complicated. Medicare actually checks your finances (well, your tax return) from two years ago to set your premium. So, for medicare part b premium 2025, they’re eyeballing your 2023 reported income. If you were over $106,000 (single) or $212,000 (filing jointly), you’ll be asked to cough up more each month—sometimes significantly more.The official booklet spells it out for each income bracket.

Most people don’t hit those numbers, but if you do—even by accident, like cashing out an investment—you’ll see what’s called an “Income-Related Monthly Adjustment Amount” (IRMAA) tacked onto your bill. This can take your premium up to $259, $370, $480.90, or more a month (gulp). Only about 8% of folks pay these higher rates, but sometimes that surprise letter from Social Security… yep, it’s a day-ruiner.

What If You’re There “By Accident”?

I’ve actually fielded this question for a handful of overwhelmed neighbors. One woman had sold her home, retired, and didn’t even realize that big “one-time” gain would pop her into the IRMAA club for the next year. “It’s not like I got a raise!” she said. If that’s you—good news, you can appeal. Medicare will review changes like retirement, death of a spouse, or selling property. But you’ve got to send paperwork. (Fun? Not really. But stick with it.)

Key Income Brackets for IRMAA (2025)

| Income (Single) | Income (Joint) | Total Part B Premium |

|---|---|---|

| ≤ $106,000 | ≤ $212,000 | $185 |

| $106,001 – $133,000 | $212,001 – $266,000 | $259 |

| $133,001 – $167,000 | $266,001 – $334,000 | $370 |

| $167,001 – $200,000 | $334,001 – $400,000 | $480.90 |

| $200,001 – $500,000 | $400,001 – $750,000 | $591.90 |

| > $500,000 | > $750,000 | $628.90 |

Have you ever wondered why your neighbor pays way more… but you pay the base rate? That’s it. It’s not arbitrary, it’s just tax math (the most boring kind of math, if you ask me).

What Exactly Is Covered—And Why It Matters for Diabetes

If you’re still with me, let’s zoom out for a second. What does your Part B premium get you, anyway? For folks living with diabetes, quite a lot actually:

- Blood sugar monitors, test strips, and lancets

- Continuous glucose monitors (CGM)

- Insulin pumps and insulin (if prescribed for use with a pump)

- Medical nutrition therapy & diabetes self-management training

- Yearly diabetes screenings and necessary lab tests

- Therapeutic shoes or inserts (if medically needed)

- Visits to your endocrinologist or diabetes educator

- Podiatry care for foot health—critical for long-term quality of life

The key? You need a prescription and you have to use a Medicare-approved supplier. What about old-school insulin pens or syringes? Those are usually a Part D thing (yep, that’s another story for another day… or you can peek at the medicare part b premium 2025 breakdown for more details).

How This All Plays Out—Day to Day

Let me give you a tiny story: Last winter, my uncle Ray—a stubborn guy, but loveable—skipped his doctor’s appointment to “save money.” Fast forward two months: A small untreated foot sore turned infected, and suddenly Mr. Penny-Pincher was on the hook for a big hospital copay, plus weeks of hassle. He now jokes that “Medicare is my best friend with diabetes…” but only after some seriously expensive lessons. Don’t be like Ray. Use the coverage you’re paying for, even if it means chipping in that premium each month.

And trust me, if a diabetes class or “nutrition lesson” ever sounds boring… go anyway. Sometimes the best tip is a tiny hack that someone like you discovered—not in a study, but at a folding table with free coffee. That’s real healthcare.

What to Watch for in 2026 (and Beyond)

It’s annoying, but this is a moving target. The Medicare Part B premium 2026 hasn’t been set in stone yet, but… if history repeats (doesn’t it always?), brace for more “modest” jumps. They stack up, so keeping tabs on your Social Security check—or that Medicare billing letter—is more important every year. If it climbs a lot, don’t be afraid to call and ask questions, appeal changes, or shop for extra coverage to bridge your own unique diabetes management needs. That’s what they’re there for (even if sometimes the hold music tests your patience).

Tips to Make It Less Painful

- Set reminders—open and read every Medicare mailer, even when it looks boring.

- Appeal higher premiums if your income changed dramatically (retirement, etc.).

- Make the most of every covered visit, device, and class. You’re paying for it now, so get ahead of health curveballs.

- Ask your doctor for prescriptions for all eligible supplies at once, so you’re never scrambling or double-paying.

- Share your story—honestly. Sometimes, a neighbor’s trick is the best budget hack you’ll ever learn.

If you want more tips as this all shifts, I keep eyeing the updates over on the medicare part b premium 2025 page… and honestly, the gossip in waiting rooms is faster than the letters they send out.

Wrapping Up—Let’s Make This Work for You

This year, your medicare part b premium 2025 is a little higher. I won’t sugarcoat it—that stings. But also, I hope this helps you see why it’s truly a bridge to better (and frankly, more affordable) diabetes care. With the deductible going up as well, I know it’s tempting to ignore it all and “just hope for the best.” Been there. But here’s the thing: ignoring your coverage, skipping visits, or rationing test strips always ends up costing more—in money, in pain, in hassle.

So, here’s your pep talk, friend: take five minutes this week to double-check your own premium rate (is IRMAA hitting you? Can it be appealed?). Make sure every prescription or device you’re using is actually covered the smart way. Book that “boring” annual check-up, because it’s a tiny step that might save you giant headaches down the line.

And if this year’s premium still feels unfair, start planning ahead for when the Medicare Part B premium 2026 details drop. There are always little ways to game the system (legally!) if you know what’s coming.

Stay curious, stay proactive, and don’t be afraid to compare notes with the people (and resources) around you. This is your health journey—yes, there’ll be bumps, but you’re driving. So let’s make the most of what you’ve earned. Here’s to good numbers—on your meter, and in your bank account.

Leave a Reply

You must be logged in to post a comment.