Sticker Shock Ahead?

Let’s start with a little shocker: the Medicare Part B premium for 2026 is jumping… and we’re not talking about a tiny hop. We’re looking at an increase to $206.50 per month—up from $185 last year. Feels huge, right? That’s more than 11% higher, and honestly, who budgeted for that? If you’re living with diabetes—or you love someone who is—it’s time to chat about what this new number really means and how to keep your health and wallet in balance.according to reports on 2026 medicare changes

Why do costs keep rising? And what can you really do about it in a world where groceries, glucose test strips, and gym memberships all seem to cost more every time you blink? (Anyone else feel like their wallet is in a perpetual game of dodgeball… and it’s losing?)

Why Is Everything Getting Pricier?

What’s Driving This Big Medicare Jump?

You might be wondering… seriously, why does everything health-related always go up? The official line: Medicare’s costs are rising because more boomers are retiring, folks are living longer, and diabetes care (with all those blood sugar monitors and check-ins) isn’t getting any cheaper. Hospitals, outpatient clinics, even routine care—we’re all using the system more, and yes, prescription drug prices are doing their own sky-high thing.according to Kiplinger’s Medicare outlook

Here’s a little secret: these premium hikes are partly tied to policy changes, too. Medicare is focusing more on wellness and prevention rather than just “fix it when it’s broken.” For diabetes, that means more covered education, coaching, even digital support. All great—unless you’re the one footing more of the bill each month.

True Story Time

I had coffee with my friend Carl last week. He’s had type 2 diabetes for fifteen years. Carl’s super organized—tracks every cent, every carb. When he heard about the Medicare Part B premium 2026 bump, he literally pulled out his phone, recalculated his spending plan, and sighed. “That’s a few months of test strips or maybe an A1C checkup I might have to push out.” Honestly? My heart sank a little. These price jumps are real for all of us—not just “big picture” numbers on a government website.

The 2026 Price Tag, Broken Down

What Does the New Premium Get You?

So what will that $206.50 a month actually cover? In the world of diabetes, Medicare Part B includes stuff like:

- Doctor office visits (checking in on that blood sugar!)

- Outpatient care—diabetes educators, endocrinologists

- Diabetes screenings and lab work (think: that important A1C test)

- Blood sugar monitors and some diabetes supplies

Part B pays 80% of approved costs after you hit the deductible (which is also nudging upward—hang on, we’ll talk about that soon). The rest? That’s on you.

Who’s Hit Hardest by Surprises?

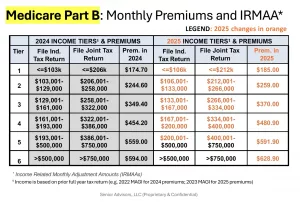

Here’s the twist: if you happened to bring in a higher income in 2024 (even if you’re not feeling “wealthy” now), you might pay more in 2026—thanks to something called “IRMAA” (Income-Related Monthly Adjustment Amount). It’s a two-year lookback. So, that big year you cashed out savings or did a delayed retirement bonus? It haunts your Medicare costs later.according to updated projections for Medicare costs in 2026 IRMAA can add anywhere from $82 to almost $500 extra per month to your premium. Yep, almost double in some tiers.

Let’s Get Visual—Quick IRMAA Table

| 2026 Income (Single) | Extra Part B Surcharge (Monthly) | Impact for Diabetes Care |

|---|---|---|

| Under $109,000 | $0 | Standard cost |

| $109,001–$137,000 | $82.60 | Manageable, but watch budget |

| Over $500,000 | $495.60 | Prepare for premium sticker shock |

Want to see where you land on the full premium ladder for this year? There’s a super handy Medicare part b premium 2026 chart that lays it all out—especially helpful if you just want the numbers without the drama (but hey, I like a little drama sometimes, if I’m being honest…)

Deductibles: The “Hidden” Hike

How the New Deductible Impacts You

Don’t forget the other number that sneaks up on you: the Medicare Part B deductible 2026. In 2026, that’s going up to $288—up from $257 the previous year. Maybe that doesn’t sound like much at first, but if you check in with your endocrinologist or get labs a few times a year, you will probably hit this quickly. And costs for those very first visits or tests? Yup, that’s out of pocket, before Part B even starts sharing the bill.

Need to get into the nitty-gritty of how that shapes your diabetes routine? I found the Medicare Part B deductible 2026 breakdown pretty useful; it walks through sample expenses so you can plan for those first-of-year spikes. (Nobody likes surprises… unless it’s your birthday, right?)

Reality Check

My cousin Yvonne hit her deductible by February last year. Between her regular diabetes screenings, foot care appointments, and a bad cold that turned into bronchitis (she swears she picked it up at her knitting group), she was in and out of doctor’s offices. By spring, she was already tallying every dollar just to keep up. It’s rough to see someone trade off medical supplies for small luxuries—like her favorite Saturday pastry.

Prescription Drugs: Catch-22?

Part D Drug Costs: Rising, But There’s Hope

Medicare’s prescription coverage (that’s Part D, not B) is also getting a tweak: the annual out-of-pocket cap is moving from $2,000 to $2,100. Not a huge jump, but if you’re using brand-name diabetes medications—or those new GLP-1s everyone’s buzzing about—ouch. (Quick PSA… those are not capped at $35 like insulin is. I had to explain that to my aunt, who was not thrilled to find out. The $35 insulin cap does help though, and that’s for each insulin you use! If you use two, it’s $70 a month, max.)

The upshot: there’s finally progress on price negotiations for 10 big-name drugs in 2026. It may take a bit for those savings to reach all diabetes meds, but fingers crossed—Medicare is moving in the right direction. Until then, my advice is to triple-check your Part D plan every year. Sometimes, the difference between plans is hundreds or thousands per year—seriously! And switching can feel scary, but it’s often way less painful than you think.

Making Sense of the New “Prevention First” Medicare

What’s Changing for Diabetes Support?

Not everything in Medicare 2026 is about higher bills—there’s actually some good news for diabetes prevention and education. Starting soon, more diabetes support is going online, thanks to a push to expand the Medicare Diabetes Prevention Program. Think digital classes, virtual coaching, even asynchronous chat with educators. The goal? To help more folks catch prediabetes early, lose some weight, and turn things around—no matter where you live. If you have a cousin who lives miles from the nearest doctor, this is real hope for rural communities.

Plus, Medicare is making it easier to report your own weight, check in from home, and get support via distance learning. This is supposed to reduce costs (to the tune of $56 million, if you believe the government bean counters…) but—shout out to everyone who feels safer at home or prefers learning in pajamas—it’s honestly about time. according to CMS innovation program updates

Quick Tips: How to Use These Changes

- This year, look for online MDPP (Medicare Diabetes Prevention Program) options with flexible schedules.

- Keep an eye out if your favorite educator gets approved for digital group coaching; it means fewer trips out.

- Don’t forget, your supplies—glucometer, strips, lancets—are still under Part B (not D!). You pay 20% after deductible, so budget for those staples early.

How to Stay One Step Ahead

Strategies That Really Work—For Diabetics Especially

Okay, practical time. What next? You’ve got to ask:

- When was the last time you compared Medicare plans, side by side?

- Do you know if you’re at risk for IRMAA? Pull out your old tax return—seriously, it’s all about your income two years ago.

- Are you using the new digital coaching and prevention tools (lots are covered!)?

My neighbor Martha (she’s a retired math teacher, so you know she loves a table) actually uses the Medicare part b premium 2026 chart every fall. She prints it, circles her range, and makes a little plan for the year—and yes, she brings it to book club. Not the party life, but hey, she never gets caught off-guard by premium jumps.

And don’t be shy about talking with your pharmacy or doctor’s office—they can sometimes spot ways to save, or let you know about programs and samples you didn’t realize were out there.

Another quick reminder: October 15 through December 7 is open enrollment. Put a reminder on your phone now. That’s your window to change plans, update your choices, or just make sure you’re still getting the best bang for your buck (and that your diabetes meds and specialists are still covered next year!).

Diabetes Wellness Checklist for Medicare 2026

- Review your Social Security and Medicare letters for any updates—don’t just toss them!

- Double-check your diabetes supply coverage, especially if you use more than one insulin or new meds.

- If your income went up or down, look into IRMAA appeals or strategies to reduce future surcharges.

- Take advantage of new diabetes prevention virtual classes—it’s included, so why not?

For more cost details and deductible scenarios, keep that Medicare Part B deductible 2026 info handy—it could save you a headache or two!

Wrapping It Up: You’re Not Alone

Here’s the bottom line, friend: Yes, the Medicare Part B premium 2026 is rising—maybe faster than we’d like. Yes, deductible and IRMAA hurdles can feel like hurdles in a marathon you didn’t even sign up to run. But you know what? You’ve got more tools, more community, and more options than ever. The rules are changing, but so are the resources—and the support is just getting better, especially with digital coaching and capped insulin costs.

So take a breath (seriously, let’s exhale together), grab a cup of tea, and map out your plan now. Whether it’s a tiny tweak—like switching Part D plans for cheaper meds—or a bigger step like trying a Medicare Diabetes Prevention session online, every little move counts. Lean on those handy guides like the Medicare part b premium 2026 chart and Medicare Part B deductible 2026, and remember, you don’t have to figure this out alone. Ask questions, share concerns, help a neighbor decode their bill—because none of us should have to choose between our health and our bank balance.

You’ve got this—and if you need a pep talk, advice, or just a friendly ear, I’m right here… ready to walk this (sometimes bumpy) Medicare journey with you.

Leave a Reply

You must be logged in to post a comment.